7 November 2017

Airlines don't cover themselves for failure

Earlier this summer Monarch went into administration. Flights were cancelled with little warning, holidays were ruined and around 100,000 people were left stranded.

Travel insurance exists to offer protection against events like this. In unexpected circumstances, people who have bought it should be able to breathe a sigh of relief.

But things don’t always work out the way they should.

A clear lack of cover

When an airline like Monarch goes bust and leaves people in the lurch, it’s known in the travel insurance industry as a ‘scheduled airline failure’.

However, according to our research, nearly half (47%) of travel insurance products don’t offer cover for scheduled airline failure.

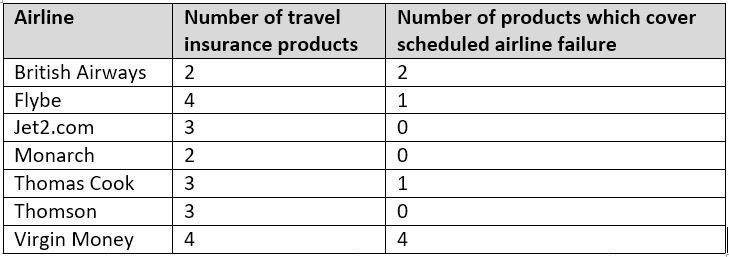

Seven of the largest airlines operating in the UK sell travel insurance themselves. But only 8 out of the 21 products on offer cover passengers against the risk of airline failure.

Neither of Monarch’s policies provided this type of cover for their passengers. And among airlines’ own-brand travel insurance policies, it tends to only be the more expensive options which include it.

Learning from the past

It isn’t like airlines going in administration is a rare thing. Bmibaby closed in 2012, Astraeus Airlines in 2011, Zoom Airlines in 2008 - just to name a few.

When the Icelandic volcano Eyjafallajökull erupted in 2010 insurers responded by amending their policy documents and making it clearer to customers what will happen in these situations. However, it doesn’t feel like many have learnt from the past when it comes to scheduled airline failure.

The frequency and importance of airline failure convinced us that it should one of the red lines in our travel insurance product ratings. This meant that to be rated 5 stars by us a policy would need to offer at least £1,500 worth of cover in the event the airline a customer was flying with went bust. This may seem high – but whilst Monarch only operated short-haul flights, £1,500 would be needed to get back from further afield at the last minute.

Impact on the industry

The big problem with this whole situation is that many travel insurance products do cover airline failure. So it’s up to the providers who don’t cover it to wave a red flag on products which don’t.

Monarch mentions – in clause ‘n’ of section 5 of its policy document – that claims “arising directly or indirectly from scheduled airline failure” aren’t covered. But it doesn’t explain what this means, and there isn’t even a definition. The term means little to consumers so it’s critical this is explained in a language they can understand.

During our research, we found that airline failure was regularly presented as being included when it actually was optional. Or it was only included with premium products. We had to call lots of insurers to double check the facts – and sometimes, even the call handlers didn’t have the answers.

Consistent problems

Insurers mustn’t only talk about what they cover. Highlighting the (often unnecessarily high – more on that soon in our upcoming research report) medical limits in travel insurance is all well and good.

But if they don’t also talk clearly about the key exclusions then there’s a problem.

This seems to be a particular issue with travel insurers as our previous blog highlighted. It’s a fine balance talking about the two sides of a policy – what’s covered and what isn’t – but one insurers must get right.