10 September 2014

Endsleigh selling PPI with its insurance policies

Payment protection insurance mis-selling has been one of the biggest scandals in the financial services industry's history. The bill for compensation is currently running at over £16bn - and the cost to the industry's reputation could be considerably greater.

When the regulators finally caught up with the problem towards the end of the last decade, a Competition Commission inquiry was launched. The main upshot of this was that PPI could no longer be pushed to customers at the same time as a credit product. If lenders wished to sell PPI, they needed to wait a few days and then make an approach at a time when the customer was better placed to consider their options.

The Competition Commission report - and a series of FSA fines for companies who had mis-sold PPI - pretty much destroyed the industry. Although the almost complete disappearance of PPI is arguably not a good outcome (as the principle behind the product was sound), it only seemed right that the industry should retreat and reconsider if and how these kind of products should be sold to customers.

Carrying on regardless

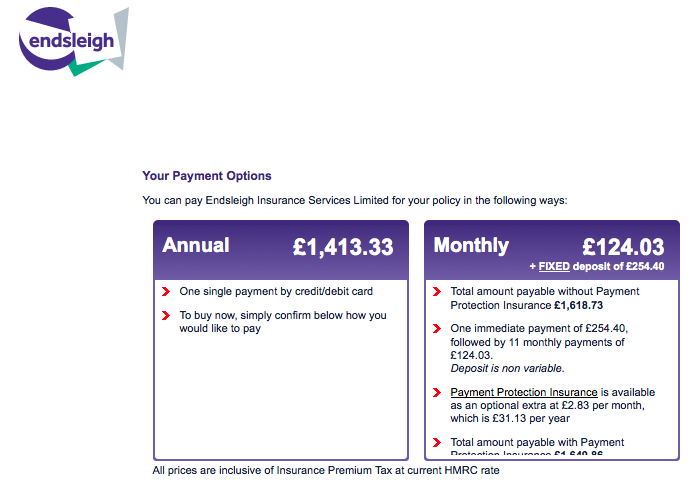

But PPI is not completely dead. While carrying out our latest transparency research, we were astonished to discover that Endsleigh, a well known insurance broker which is owned by Zurich, is selling PPI alongside its car and home insurance policies. If you opt to pay monthly, you'll be given the option to add it onto your policy there and then - with no upfront disclosure about the policy's limitations and no health warnings about its suitability.

I'm not a compliance expert - and the Competition Commission's report into PPI is fairly impenetrable. But surely its point of sale ban was meant to apply to situations such as this. Endsleigh is not charging much for the policy - but an extra £30 off a few thousand customers is money for all rope, given that claims levels are likely to be negligible. Endsleigh says it was given OFT clearance to sell PPI like this - but at the very least, it should be providing much more information, and helping the customer to understand what they're buying.

If you search for the PPI small print, you can find it in Endsleigh's 37,000 word car insurance policy document (the longest of any insurer we've seen) - and, just like most PPI policies, it has some very tight restrictions around claims relating to stress and back pain (the two most common reasons that people end up out of work).

If this is not in breach of the Competition Commission's ruling, then I'd argue that it's in breach of the Financial Conduct Authority's Treating Customers Fairly principles.

Companies such as Endsleigh - and their parent Zurich - should know better, and be keener to set a good example. If they want to have a serious conversation with their customers about how to protect them if they're out of work, then I'd applaud them. But tacking on poor quality cover at the end of a car insurance quote is poor practice. We'll be passing our findings onto the FCA.