19 October 2022

Can Amazon disrupt the insurance comparison market?

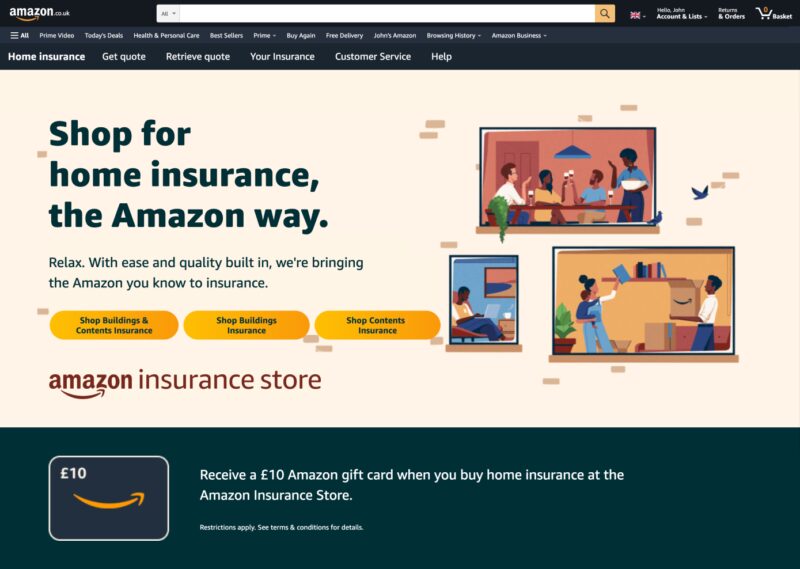

Amazon announced plans to launch into the home insurance comparison site this week – taking on the likes of Moneysupermarket and Comparethemarket. It’s an odd time to be launching into this competitive market – and is certainly not an obviously straight forward opportunity for Amazon to convert.

But let’s start with the positives. Amazon appears to have created a pretty straightforward customer purchase journey – and perhaps the USP of the site is that every policy that is listed on the site will have a minimum level of cover. Amazon says this has been researched as being the minimum that customers need.

When it comes to the results table, customers will be shown the customer star rating reviews that they’re used to on the shopping site. But another first will be that insurers will also have to share claims acceptance rates for policies sold on the site.

These innovations attempt to tackle two of the main problems in the insurance market. First, price comparison has generally led to a hollowing out of products – as firms reduce levels of cover and increase excesses and fees in an attempt to allow them to keep prices as low as possible, and remain at the top of the comparison table. This leaves customers more vulnerable to buying products that are sub-standard and don’t meet their needs – a problem that the minimum standard of cover aims to deal with.

Secondly, when it comes to insurance, the product itself is merely a promise. And it’s not worth the paper it’s written on if the insurer has a bad track record at keeping its promises. So some transparency around claims stats is certainly a welcome development.

The right minimum standards

But there are problems with both of Amazon’s remedies. First up, Amazon draws out just seven elements of its minimum cover on the results page - and this is what they are:

· £1m of buildings cover

· £50k of alternative accommodation cover

· 20% of contents £2,000 limit for each valuable

· £5k for contents temporarily away from home

· £5k for home office equipment

· £2.5k theft from outbuildings

· £500 for the contents of your freezer

Each of these has some value – but out of the dozens of features that make up a home insurance policy, I’m not convinced they are the seven most important. In fairness to Amazon, elsewhere on the site, they explain that their minimum standard also includes:

- £2m liability cover

- £5,000 for trace and access (finding a leak, and fixing it)

- £500 for keys and locks

- £25,000 of alternative accommodation cover on content policies

Running through the high level ones, the first thing that jumps out is that the level of buildings cover is generally not a problem with home insurance. It's typically determined by the value of your home – and set based on the rebuild value – so underinsurance on this part of home insurance policies is rarely an issue (it's more commonly a problem in contents insurance.

Amazon's £1m of cover is easily enough to rebuild most homes - but in reality, insurers will have worked out the actual rebuild value for each property they insure - and know full well that £1m will rarely be needed. £5k for home office equipment seems a bit artificial given that a home office in today’s world is generally a computer or laptop and maybe a monitor – which would be covered by most policies anway. £2,500 from outbuildings is a little on the light side – the most common level of cover in the sector is £5,000 and the average is £3,000. And the contents of your freezer? Well, it may be important if you keep expensive meats in there. For me, it’s a few packets of fish fingers , blueberries and a half eaten tub of ice cream – approximate value £12.50.

In terms of the secondary features that are not drawn out in the journey, it's good to see that Trace & Access is included as this is a really important one. But the £500 for locks and keys looks a bit light. And I wonder where some of the other important elements are - such as whether they replace your belongings new for old - or whether they’ll replace a whole kitchen or three piece suite with matching units if part of it is damaged. And what about the insurer's definition of how fast the wind has to blow to constitute a storm?

So while I like the idea, I’m not sure Amazon has hit on all the right minimum standards as it’s starter for 10. Hopefully there’s room to change and evolve those as time goes on.

When is a claim a claim?

When it comes to claims stats – my main concern is what auditing will be done of the statistics. When is a claim a claim? If I call up and say I want to claim for damage to my roof and I’m told that it’s not covered cause it’s wear and tear – is that logged as a claim, or is it just logged as an enquiry? I know that if these stats are being published, insurers will be keen to ensure they are presenting their best side.

Amazon has also made a virtue of the fact that its journey is quicker and slicker than many other insurance journeys. However, next to Aviva’s six question home insurance journey – I’m not sure it looks particularly radical. And in the new Consumer Duty world, the new buzz phrase when it comes to consumer application journeys is “positive friction” – finding ways to slow journeys down and help customers understand what they are buying. In that context, the Amazon experience may not be hitting the right notes.

One detail that slightly baffled me is that the site is to launch with a panel of just three insurers – Ageas, Coop and LV. Coop and LV are household names – but neither of them are quite what they used to be. While Coop is still a mutual, it now outsources all its insurance to Markerstudy. The decision to front it with the Coop brand is deliberate – but it’s not quite what it appears. Similarly LV was once a mutual but is now the UK retail arm of German insurance giant Allianz.

Regardless of the strengths and weaknesses of these brands, starting with only three is incredibly thin compared to the hundreds on offer on the big comparison sites. We are of course in an economic environment where price is king – and it’s hard to see how these three underwriters will be able to be competitive across the majority of customer segments.

Odd timing

Finally, there’s the timing of it all. At the start of this year, the FCA banned insurers from offering lower prices to new customers than they offer to existing ones. This has seen a fall in switching rates – and even the existing comparison sites will soon start to feel the squeeze from that.

Amazon of course has deep pockets. And while I wouldn’t put any money on it succeeding in this market, I wouldn’t bet against it.

I can’t help being reminded of Google’s foray into this market a decade ago, when they bought Beat That Quote for £37.7m and used it to launch Google Compare – only to pull out of the market a few years and many more millions of pounds later.

Personally, I think the next generation of comparison will look totally different. It will be more personalised, with apps doing much more of the heavy lifting for you. This looks like an iteration of the existing comparison models which are ripe for disruption - but probably not like this.