9 January 2015

How do you know if you’re getting a good deal?

It's been hard not to notice the dramatic plummet in oil prices over the past few weeks. I'm just back from Christmas in Texas, where the price of petrol is now as low as $1.94 a gallon. To put that in UK terms - we're talking 34p a litre - the kind of price that makes you just want to get in your car and drive anywhere.

Back home in the UK, I don't do much driving. Like George Osborne, my mind quickly turned to the question of when airfares would start to fall. As someone who flies regularly to the US to visit family, I've been astounded by the rise in the price of transatlantic flights over the last few years - and welcomed Osborne's calls on airlines this week to pass on their savings from the drop in oil prices to customers.

Brace brace

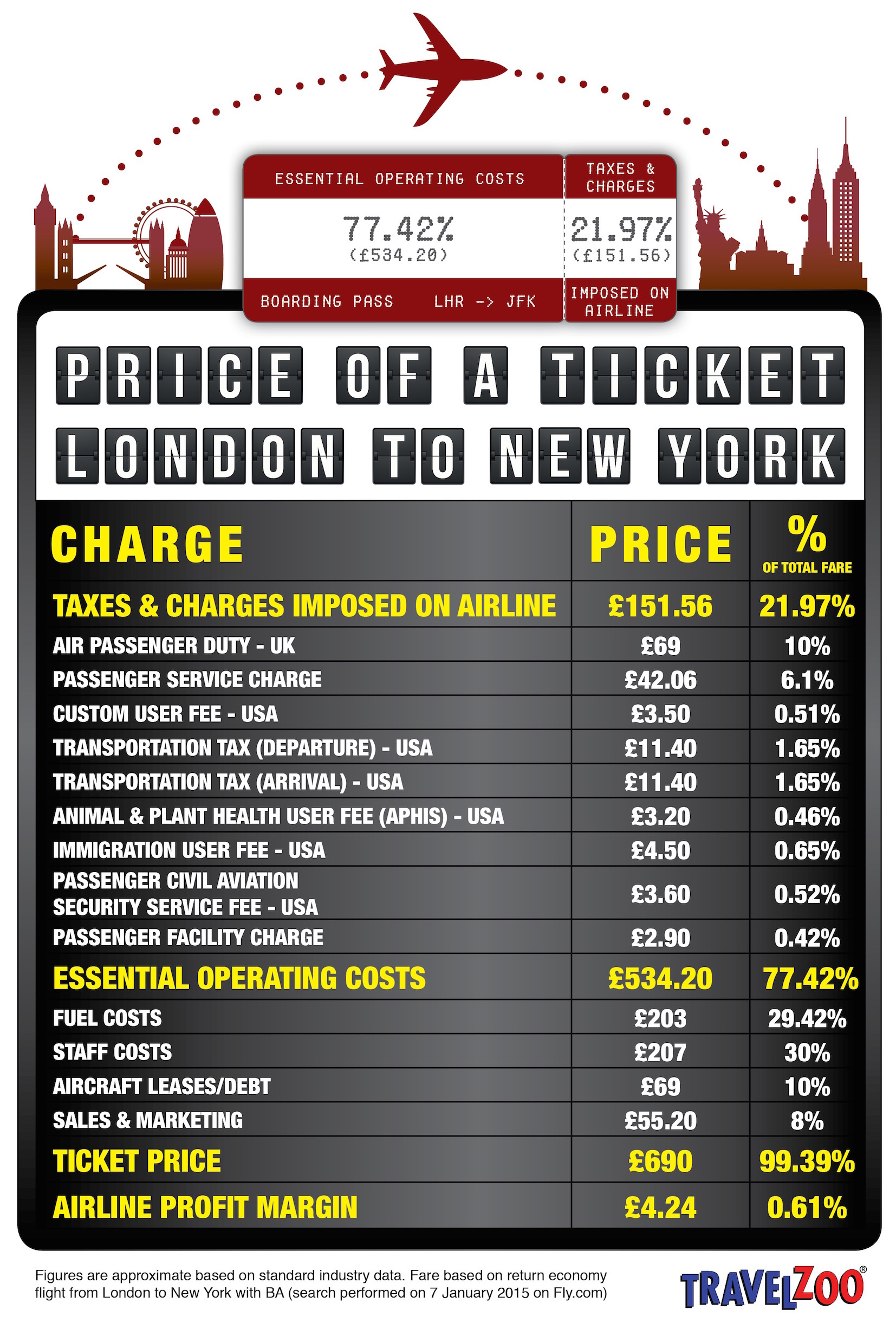

But some new research from Travelzoo today makes it clear that Osborne and I should moderate our expectations as to what a fall in flight prices might look like. Breaking down the cost of a £690 ticket from London to New York, Travelzoo shows that the cost of fuel makes up less than 30% of the price of a ticket. As you can see from the infographic below, government taxes account for well over 20%, with staff, aircraft leasing costs and marketing making up the other half. Based on these numbers, we're unlikely to see anymore than a 10% fall in ticket prices over the months ahead. Some welcome respite from the relentless increases that we've seen over the past few years, but not a return to the good old days.

This kind of breakdown is quite instructive. When you buy an air ticket - it's hard to know whether you're getting a fair price. All one can see is that prices are much higher than they were a few years ago - but is that a result of rising costs, or just a result of rising profit margins?

Travelzoo's analysis serves a reminder that the airline industry is in fact fairly lean. Only five years ago, British Airways made a loss of almost half a billion pounds. Over the last decade or so, household names such as United Airlines, Air Canada, Northwest Airlines, Delta, American have all gone bust - limping back into existence only after lengthy periods in Chapter 11 (or administration as it's known over here), or a takeover. It would seem that more transatlantic airlines have gone bust than remained solvent.

The airline market remains lean because it is so competitive, and is relatively simple. It's also easier now to compare prices than ever before.

A fair profit

Looking at companies' profit margins is a decent way of understanding whether they're offering their customers a fair price. To my mind, a fair price equals the cost of providing the service, plus a reasonable margin of up to 10%. Sadly, company margins are invisible to consumers and, in most big ticket purchases - especially for products we don't buy regularly - it's very difficult for us know whether we're being charged a reasonable price or not.

It's a problem that's particularly acute in finance, where customers make some purchases - such as life insurance or annuities - only once in their life. How on earth are they to know what a fair price might be - especially when the price for each individual will be different?

In my eutopian consumer paradise, I'd have companies publish a breakdown of their costs - and show exactly what margin they were making from the products they were selling. If customers spotted double digit profit margins, they would stop and think whether the quality and brand behind what they were buying could justify such great rewards for the manufacturer or service provider. Fairly quickly, it might expose large swathes of the financial services industry as being exploitative.

CPP was the classic example in recent times - charging as much as £85 for its identify theft insurance, at a cost of approximately £16 to the company - a 431% profit.

While there may not be many more products that are such blatantly poor value as CPP's ID theft insurance, I'd suggest that equity release, annuities and a number of different investment products are some of the numerous areas where consumers are continuing to get a poor deal. Let's hope the new consumer-focused regulator, the FCA, will shake these markets down, as it did with ID theft insurance.