8 February 2022

How to prepare for the Consumer Duty

It’s now been two months since the release of the FCA’s second Consumer Duty paper – and if your firm has not already begun discussing what your response will be, then you’re in the minority.

Although we still have to see a final policy paper in the summer of this year, all things being equal, the new rules will come into place in the Spring of 2023. While there may still be tweaks to policy, the direction of travel is clear. A number of firms we’ve spoken to have expressed their concern about the relatively short nine-month implementation period from release of the final policy statement to the go live date – but given the amount of detail in last December’s paper, there’s nothing to stop firms getting to work today. Indeed, a number of firms we’re talking to already are.

Brand new rules or updates?

For those who are still not clear exactly what the Consumer Duty is all about – and how it interacts with the existing principles, here’s a refresher.

The FCA’s existing principles of business are not going anywhere. However, the Consumer Duty will effectively replace and strengthen principles 6 and 7. Principle 6 says that firms “must pay due regard to the interests of its customers and treat them fairly”. While number 7 says firms must “pay due regard to the information needs of its clients, and communicate information to them in a way which is clear, fair and not misleading”.

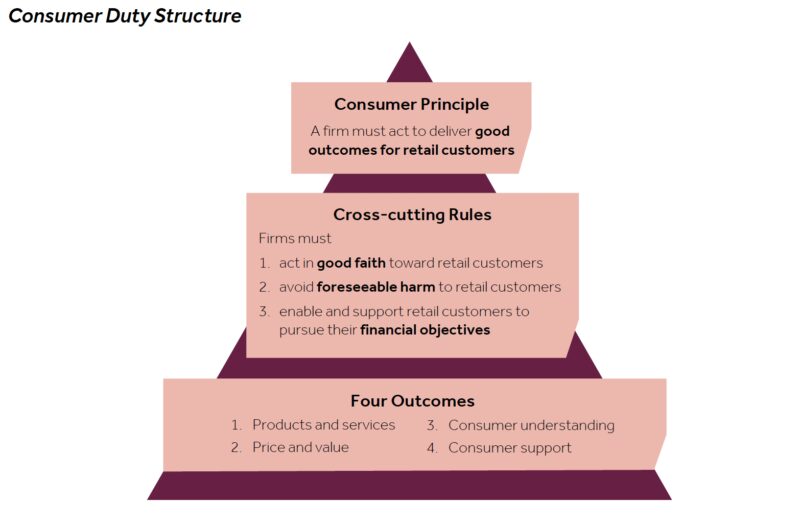

The new Consumer Duty raises the bar beyond paying “due regard” to making it clear that firms should “act to deliver good outcomes” to retail customers. It then goes further by underpinning this principle with three cross-cutting rules. Firms must

1. act in good faith toward retail customers

2. avoid foreseeable harm to retail customers

3. enable and support retail customers to pursue their financial objectives

Finally, firms must prove that they are meeting four key outcomes:

· products and services are fit for purpose

· consumers receive fair value

· communications support and enable customers to make informed decisions

· firms provide a level of support that meets customers needs.

Seismic shift

Those who see the Consumer Duty as simply a strengthening and restatement of the “Treating Customers Fairly” rules would be off the money here.

The seismic shift in approach is that firms no longer need to just satisfy themselves they are adhering by the rules, they also need to prove it.

That means testing products, assessing propositions to ensure they offer fair value, testing customer communications to ensure they are comprehensive and evidencing that customer service is meeting customers’ needs.

Helpfully, the FCA’s December paper contains over 80 pages of guidance on what it might mean in practice. This includes the revelation that firms can expect to have to demonstrate to their FCA supervisors that their business models are not reliant on poor outcomes. For parts of the market – which rely on inertia, or the deteriorating financial strength of their customers, for profit – this justification may be all but impossible to make.

What can you do now?

Firms in sectors like insurance and asset management already have a taste of what is on the way. The requirements for asset managers to carry out annual assessments of value, and the requirements on insurers to carry out annual fair value assessments are now being extended into every corner of financial services.

Insurers and asset managers who are carrying out value assessments will already be well on their way to meeting the requirements of the Consumer Duty. But of course the Duty goes further. Not least, it asks firms to prove that their communications are being understood by customers – a test that our own research shows the majority of financial services firms will fail.

The Duty also makes it clear that it expects firms to provide a level of service that meets its customers needs – which will necessitate a hard stop to some of the poor quality customer service which has prevailed since the pandemic. But it also means ensuring that you have a robust vulnerable customers strategy in place and are actively looking for blind spots and areas where customers may not be getting good outcomes.

We are already working with a number of firms across the insurance and banking sectors helping them begin this work.

It’s worth pointing out that by the time these new rules come into force, in the Spring of 2023, it will not be the regulator’s intention that every firm is flawless. But to be in good shape, you need to be going through the motions of asking the difficult questions and planning how to fix problems that are identified.

As the FCA said at our webinar at the start of February (which you can watch back here) – this is a seismic change in the FCA’s approach to regulation. It is about being more proactive and moving away from a world of reacting to bad news and punishing after the detriment has occurred.

Firms should not be afraid of this shift. If anything, it will provide more certainty, and remove the likelihood of being punished after the event.

If you’d like to hear more about the work we’re doing around the Consumer Duty – or have questions about how we can support your firm, do get in touch.