2 November 2018

Why I won’t be adding my rent payments to my credit score

Finally some good news last week – renters, like myself, who pay their rent on time will be rewarded with improved credit scores. This really is great news, as I know some of my friends who’ve looked into getting a mortgage have been frustrated by not having much of a credit footprint.

Seeing this news I thought I’d check it out myself and, hopefully, get my rating up a bit. I followed moneysavingexpert’s advice and starting setting up an account with CreditLadder. Set up in 2016, CreditLadder reports tenants’ payments to The Experian Rental Exchange so it can be added to your credit score. CreditLadder is a partner of Experian and Barclays and has been recommended by Which? The Big Issue, The Times and Metro – according to its website.

The obvious barrier

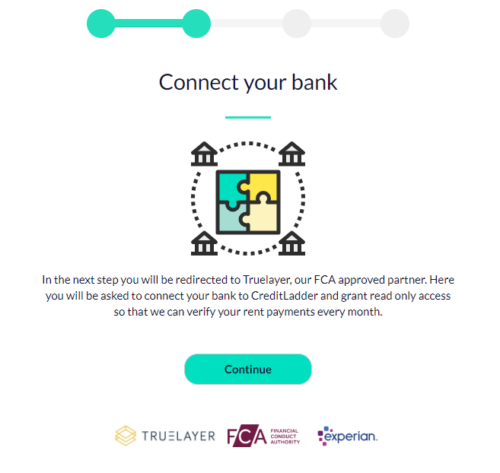

Setting up an account was relatively easy but about halfway in I was met by this:

The Open Banking Interface.

Now we’ve worked with Open Banking and sat on their panel, but this is the first time I’ve encountered it in my personal life. And I stopped the process immediately. I felt apprehensive about entering my banking details - despite knowing exactly what is and isn’t possible based on the data I’d be giving them. My hesitancy even meant I talked to my bank via chat but their advice was generic and unhelpful (“never give your details to anyone”).

And that was that – my desire for a better credit score was outweighed by my reluctance to share my data.

Transferred loyalty

I trust Experian. I trust Barclays. By extension, I then trusted their partner CreditLadder. However, once CreditLadder said I’d be redirected to Truelayer, my extended trust ended. Trust dissipates quickly the further you’re removed from the source, whether by distance, time, or something else. A second step away from Experian, for me, was enough to stop me going ahead with the process. I’m sure many people would’ve stopped before this. It’s like my friend asking if he can bring his mate to my birthday party, only for his mate to ask if he can bring someone else. No, not really.

What needs to change

I think there’s a lot that could be done to increase my trust. For example, a big concern of mine was what happens if I lose money due to data sharing. To circumvent this, I’d like this explained to me at the point I have to log into my online banking. It can’t just be explained in the Ts & Cs – CreditLadder’s terms have a reading age of 19, which is another potential barrier to many consumers. It has to be during the journey and at the moment customers might start to feel uneasy.

I hope I’ll reconsider in future, potentially when I’m considering getting a mortgage, but right now my trust just doesn’t stretch far enough. How very British of me.