19 December 2023

How do investment platforms compare when it comes to offering and displaying the interest offered on cash balances?

On Tuesday 12 December, the Financial Conduct Authority (FCA) wrote a letter to investment platform and self-invested personal pension (SIPP) operators raising concerns over how they are handling interest on their customers' cash balances.

The FCA's letter reveals that over the past 18-24 months, interest earned by providers on customers' cash balances has risen substantially, thanks to increases in the Bank of England base rate. In June 2023 alone, the firms surveyed by the FCA collectively earned £74.3 million from retaining interest. 71% of the sampled firms retain at least some interest, with an average retention rate of 50%.

61% of the platforms that retain interest on customer cash also charge a platform fee. This practice - known as “double dipping” - is particularly concerning and is arguably unfair towards customers.

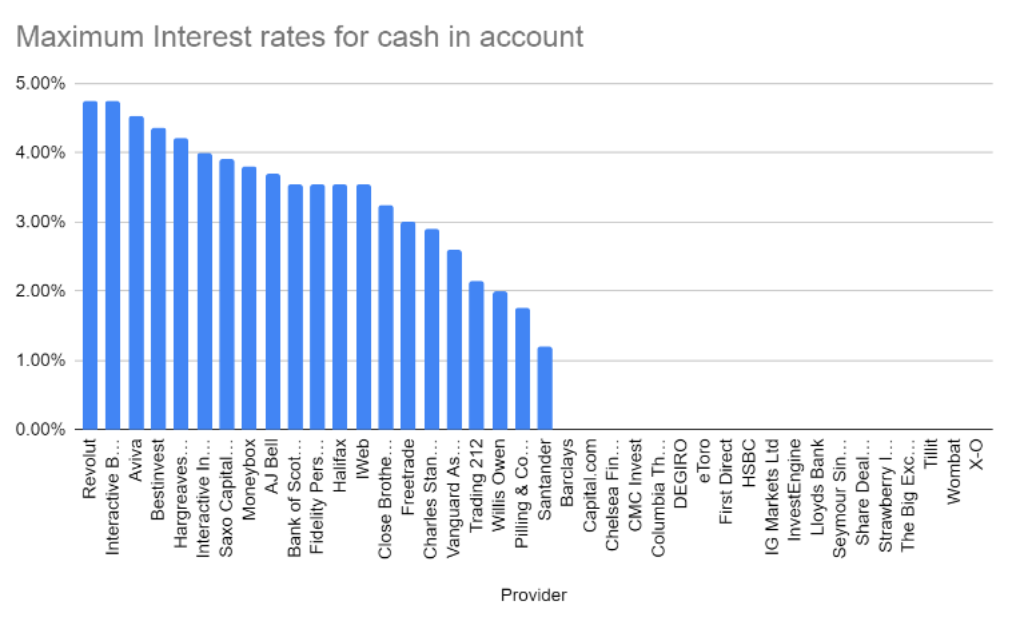

Our data shows that the highest interest rate currently offered by any investment platform on cash balances is 4.75% (Revolut Metal) and 4.74% (Interactive Brokers) . While the highest for SIPP providers is 4.53% (Aviva), followed by 4.35% (Bestinvest).

The chart below shows the highest interest rate offered by each investment platform that is included in our product ratings (some platforms offer multiple rates).

Notably, some banks like Barclays and HSBC are still offering no interest on cash, despite the rise in interest rates this year. While brands in the Lloyds banking group (Lloyds, Halifax and Bank of Scotland) offer 3.55% on their SIPPs, there is no interest available for their other account types.

Transparency around interest on cash balances

One of the key points of the FCA's letter is that there is a need for transparency in the sector. Information about interest rates on cash should be readily accessible, clear, and prominent.

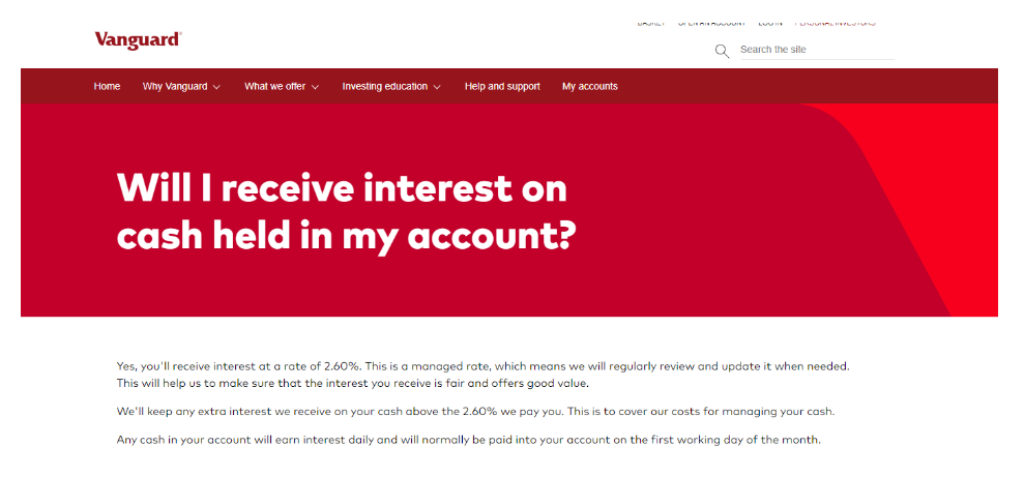

Unfortunately, some investment platforms bury this crucial information in key information documents (KIDs) or in obscure corners of their websites. For example, to find the interest rates that apply to a Vanguard account, you have to look in the FAQs or in the KID. This lack of transparency raises concerns about whether customers are fully aware of how much interest is being retained by the platforms themselves.

What happens next?

In its letter, the FCA outlined its expectations for investment platforms and SIPP operators to ensure compliance with the Consumer Duty. Firms are urged to review their approaches to interest retention, ensure fair value for customers, cease double dipping practices, and update terms and conditions for clarity. The FCA expects these changes to be implemented promptly, with confirmations due by January 31, 2024, and corresponding changes by February 29, 2024.

This shows the importance of complying with the new Consumer Duty. We will keep a close eye on how investment firms respond to the FCA’s actions, in terms of modifying their fees, offering interest on balances, and altering communications to make them clearer.