1 November 2023

Why investment terms and conditions fall short

Investing can be complex and often intimidating. Whether you're a seasoned investor or just starting out, you'll likely be confronted with a barrage of financial documents, including terms and conditions, that can leave your head spinning.

Terms and conditions are meant to provide clarity and transparency, but the reality is often quite different. In our most recent Customer Experience analysis, from October this year, we found that the investment sector has some of the worst terms and conditions of all financial sectors.

Here I look into the reasons why investment terms and conditions are falling short, what investment providers can do to improve them, and why this is necessary under the FCA’s Consumer Duty.

The state of investment terms and conditions

Our terms and conditions analysis revealed several eye-opening insights into the quality of investment terms and conditions. Here are some of the key findings.

Excessive Length: Investment terms and conditions have an average length of 23,497 words. Only travel insurance terms - at 25,203 words on average - are longer. Such lengthy documents can be overwhelming to investors, particularly those who are just starting.

Jargon: Investment documents have an excessive use of jargon. We measure jargon using our own ‘jargon checker’ tool that grades documents based on the severity of their jargon and how many jargon terms are in the document. Out of all the sectors we analysed, investments documents scored worst for jargon. The IG Markets terms has over 2,500 words that we flag as jargon, many of which could be swapped for simpler alternatives, such as “undertake”, “execute”, “irrevocable” and “proprietary”.

High reading grade: We compare the readability of documents using the Automated Readability Index (ARI). This works out a ‘reading grade’ by analysing the average word length and sentence length of a document. With an average reading grade of 13.5, investment terms and conditions require a high level of literacy to comprehend (roughly equivalent to a reading age of 18). This excludes a significant portion of the population from fully understanding the agreements they are entering.

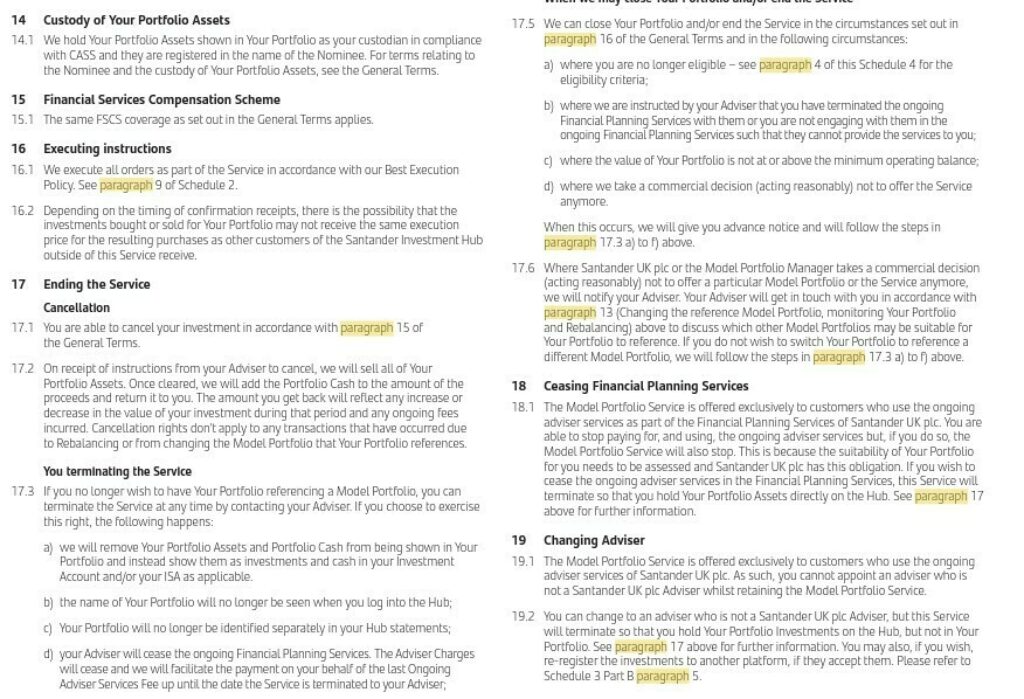

Inter-Referencing: Investment documents are full of inter-references (e.g. ‘see section 1.2’ or 'in accordance with paragraph 3'), with an average of 25 per document. This means that readers need to constantly flip back and forth between sections, making it difficult to fully understand the contents of the document. Santander’s document is one example of complicated inter-references.

Lack of Colour: Investment terms and conditions tend to have very few colours. Many use only black and white text. This lack of visual differentiation can make it difficult to locate critical information and is generally off-putting to readers.

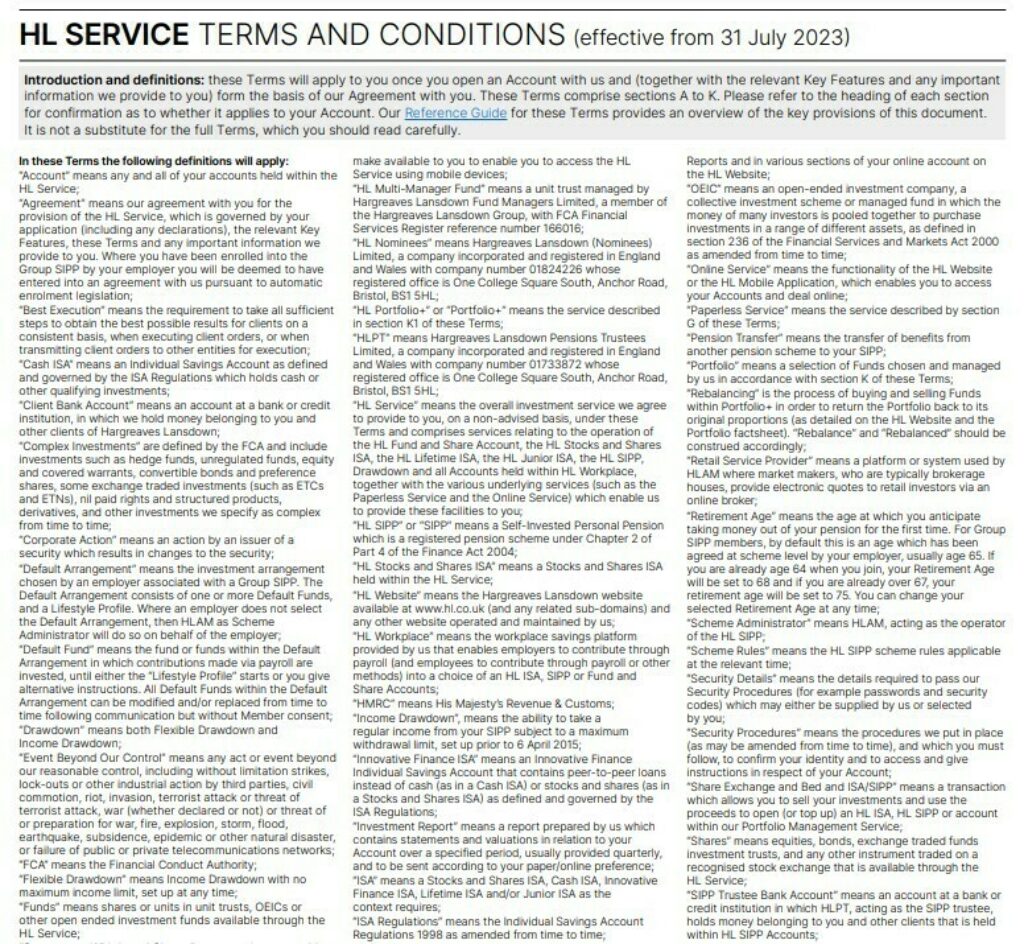

Spacing: Investment terms and conditions have the most words per page of any sector, with an average of 778. The result is that these documents feel cramped and overwhelming. The Hargreaves Lansdown document below is one example.

What investment platforms need to do to improve their documents

To address these issues and make investment terms and conditions more user-friendly, investment providers should consider the following steps:

Shorten Documents: Make documents more concise and reader-friendly by reducing the excessive word count. Shorter sentences and words can greatly enhance readability.

Reduce Jargon: Simplify the language and aim for a reading grade below 8 to ensure that more customers can understand the terms and conditions.

Eliminate Inter-referencing: Minimise complicated cross-references within the document to create a more linear narrative and avoid sounding overly legalistic.

Contents Pages: Having a good contents page is crucial to making terms and conditions easily navigable. Since most people don’t read these documents from cover to cover, it’s essential for them to be able to find the section that they need. The best tables of contents are interactive, with clickable links, and are structured to anticipate likely customer questions.

Colour: Use at least three colours and ensure there are no colour contrast issues. This will make the document more appealing visually and provides a way to make key information stand out.

Font Size: Use a font size of at least 10pt to make the text easily readable.

Spacing: Aim for fewer than 400 words per page to create documents that feel well spaced and approachable.

Implications of the FCA's Consumer Duty

Customer Understanding is one of the key outcomes of the FCA's new Consumer Duty. When terms and conditions are unclear or overly complex, investors may make uninformed decisions, potentially leading to bad outcomes.

Investment terms and conditions are notorious for being lengthy, full of jargon, and confusing. To fulfil their obligations under the Consumer Duty and promote transparency and fairness, investment providers need to take concrete steps to create documents that are shorter, simpler, and more user-friendly. This will help to give investors the knowledge they need to make informed decisions and build trust in the sector.

You can find more information on our document rewriting services here. For enquiries, email corporate@fairerfinance.com