24 February 2015

Banks and insurers make the wrong call in one out of every two complaints cases

Banks and insurers are failing to make the right decision in less than half of all customer complaints rulings, according to new data released today by the Financial Ombudsman Service

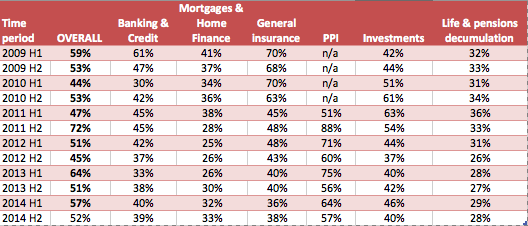

Some 52% of complaints that were referred to the Ombudsman between July and December 2014 were upheld in the customer's favour, overturning the company's original decision to reject the complaint.

The data marks a slight improvement on the previous six months, when 57% of Ombudsman complaints were upheld in the customer's favour. However, the uphold rate is worse than the last six months of 2013 when 51% of rulings went against the company.

While payment protection insurance continues to dominate the Ombudsman's caseload, this area saw an improvement during the second half of 2014, with 57% of all PPI complaints being upheld in the customer's favour - down from 64% six months ago.

At an individual firm level, HSBC continued to undo its reputation as one of the best large banks for handling complaints. Some 82% of complaints about its subsidiary HFC were upheld in the customer's favour. Overall, HSBC saw an improvement in its uphold rate - down to 52% from 78% - mainly driven by a better performance in its PPI complaints. However, its uphold rate amongst Banking & Credit complaints rose to 35%, the highest level for the bank since 2009.

Lloyds Bank also had a bad six months, with its uphold rate at the Ombudsman increasing to 74%, up from 66% in the previous six months.

Nationwide Building Society continued to show that it's possible to be a large company and handle complaints fairly. Overall, just 9% of Nationwide complaints were upheld in favour of the customer - down from 12% in the previous 12 months.

Commenting on the data, James Daley, founder and managing director of consumer group Fairer Finance, said: "The fact that more than half of all Ombudsman complaints are being upheld in the customer's favour shows that cultural reform has barely begun in the banking and insurance industries.

"By the time a complaint gets to the Ombudsman, companies have already missed their first chance to put things right. And if the Ombudsman is overturning a substantial proportion of a company's decisions, it's a clear sign that a business is not focused on putting its customers first.

"Nationwide Building Society - which has over 14 million customers - continues to put the rest of the industry to shame. If a business of such scale can manage to have less than one in 10 Ombudsman complaints upheld in the customer's favour, there's no reason why every other major bank and insurer could not be doing the same."

Notes to Editors

For more information, or to speak to James Daley, please email media@fairerfinance.com or call 07747 830105.

Fairer Finance is a consumer group and financial ratings service, ranking banks and insurers based on customer feedback, complaints handling and transparency.

Percentage of Ombudsman complaints upheld in the customer's favour, by sector: