5 March 2024

Navigating Auto-renewals in Home Insurance: A Guide to Consumer-centric Practices

Automatic contract renewals in financial products offer convenience by ensuring continuous coverage, but they also present challenges.

While auto-renewals prevent gaps in coverage, they can exploit customer inertia, leading to customers potentially overlooking better alternative products due to complacency.

Firms must adhere to the FCA Handbook principles, offering accessible methods for managing auto-renewal. This means creating a user-friendly process without unnecessary barriers. It’s also essential to provide customers with ample information so they can make a well-informed decision between auto or manual renewal.

The question then becomes: how can insurers balance consumer protection and choice amidst the benefits and risks of auto-renewal? To answer this, I've analysed 45 home insurance online journeys.* In this blog, I'll go through examples of frustrating online user experience (UX), focusing on the concepts of ‘cognitive load’ and ‘dark patterns’, as well as exploring what makes for a smooth and transparent auto-renewal process during online purchases.

How does auto-renewal work?

Typically, customers are automatically enrolled in auto-renewals unless they actively choose to opt out. This system acts as a safety measure, ensuring that customers maintain coverage if they forget to review their home insurance policies annually. Auto-renewal offers several benefits: it’s convenient, ensures continuity, and streamlines the process for both insurance providers and policy holders.

That being said, it is essential for policyholders to periodically review their coverage to confirm it still meets their needs and remains competitively priced. This blog primarily addresses a specific group of customers - those who feel confident in their ability to explore better insurance options. We’ll refer to them as ‘confident customers’.

Reducing end-users’ cognitive load

Making things easier for customers during online purchases is crucial. Brands should strive to reduce the mental effort required to complete financial tasks, known as cognitive load. One simple way to do this is by offering customers a clear choice between automatic and manual renewal when designing online purchase journeys.

In my analysis of purchase journeys, I found that 20% of brands did not provide customers with an option to opt out of auto-renewal before purchasing policy. This lack of choice can add unnecessary complexity for confident customers.

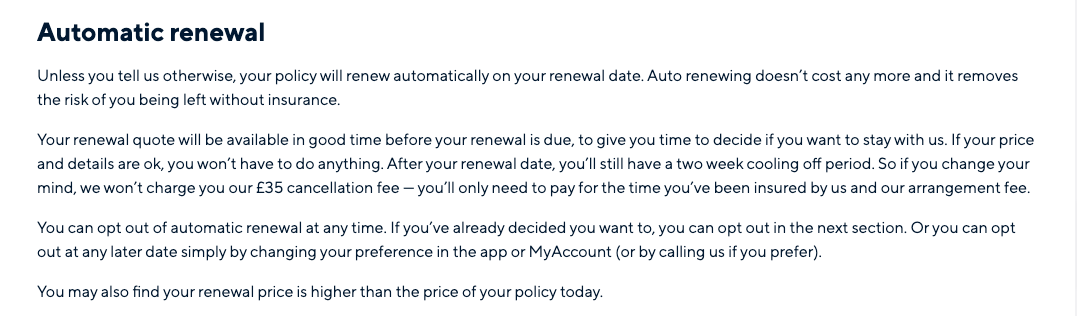

Hastings Direct (05/03/2024)

While it is important for brands to have clear ways customers can opt out of auto-renewal at any point in the policy’s lifecycle, it is also vital that they give a clear and simple option before customers purchase a policy. Having to navigate through additional processes like customer experience portals, call centers, or emails adds unnecessary cognitive load that can be avoided with good UX design.

My recommendation for brands is to present customers with a clear choice between automatic and manual renewal before they finalise their policy purchase. Failing to do so may lead to customer inertia, where they end up automatically renewing even though they’re confident in exploring better options before renewal.

Dark patterns

In UX design, intentionally adding extra steps for end-users, especially when simpler solutions exist, is known as employing “dark patterns”.

In my analysis, I found that 29% of the journeys required customers to click an extra button or extension to opt out of auto-renewal. This means that in nearly a third of cases I studied, customers encountered unnecessary complexity when trying to opt out of auto-renewals. This complexity can lead to user fatigue, frustration, and confusion. Users might feel overwhelmed or inconvenienced by the extra steps, which could discourage them from completing the opt-out process altogether.

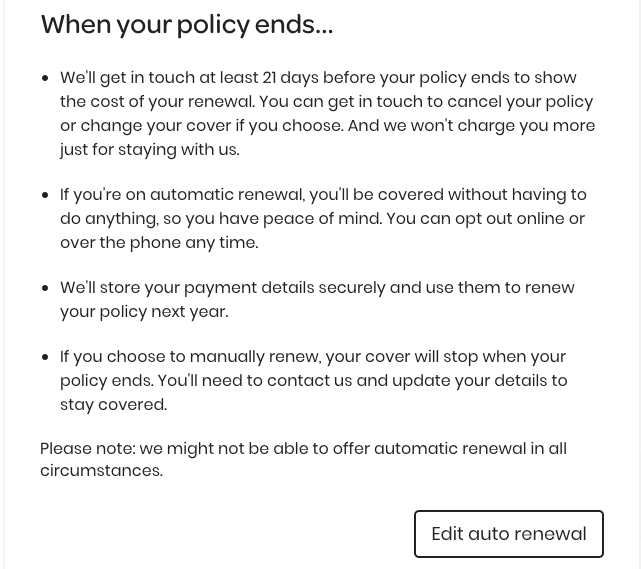

Churchill (05/04/2024)

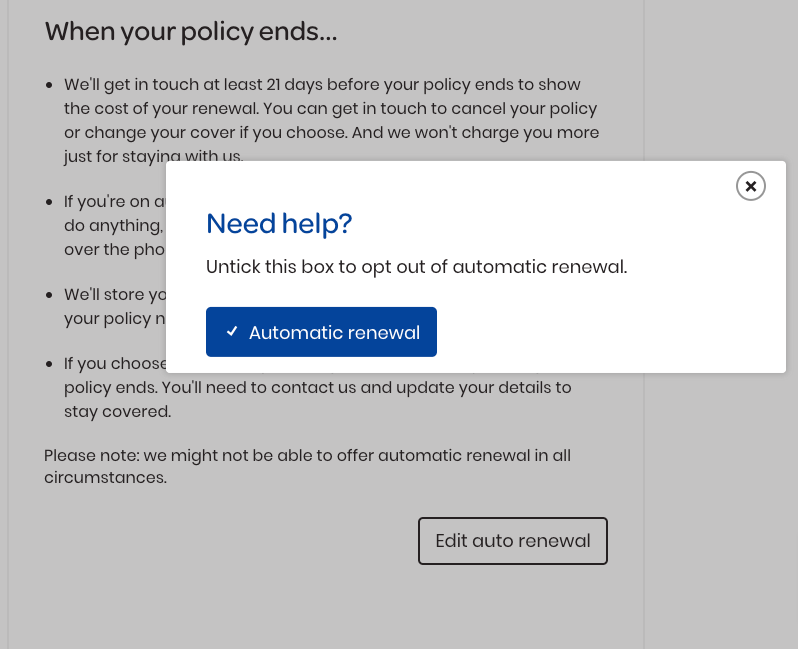

To avoid dark patterns, brands should keep things simple. They should present information about auto-renewal without requiring additional clicks, as shown in the example below.

Co-op Insurance (12/02/2024)

Balancing clarity with information overload

Designing auto-renewal opt-ins involves striking a balance between clarity and avoiding overwhelming customers with too much information. Let’s explore the different approaches observed in online purchase journeys.

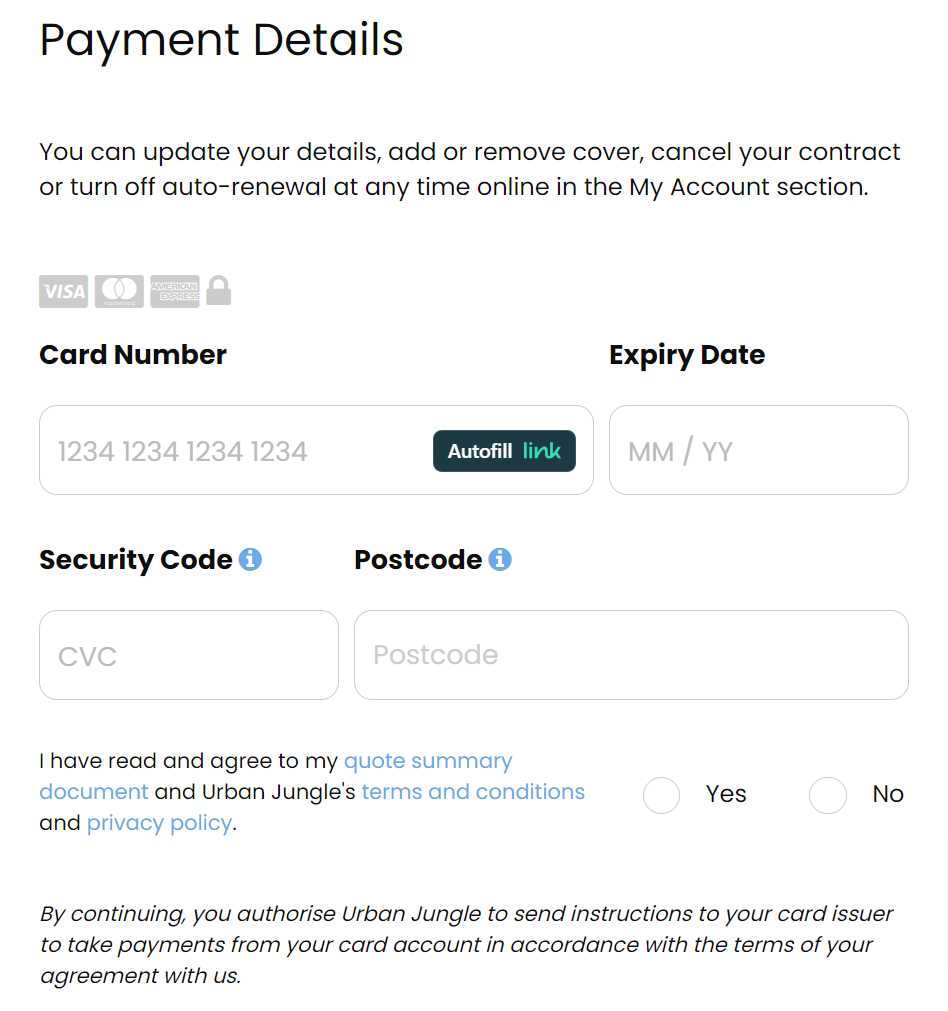

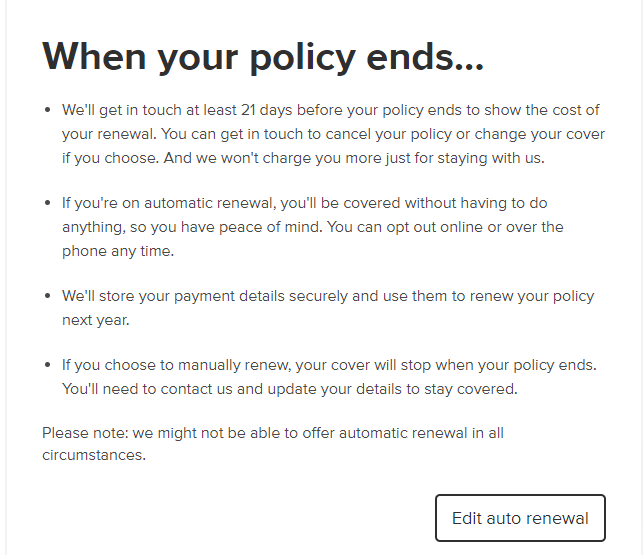

From the straightforward approach of Urban Jungle to the detailed information provided by Privilege, there's a wide range of how much information customers receive about auto-renewal.

Urban Jungle (21/02/2024)

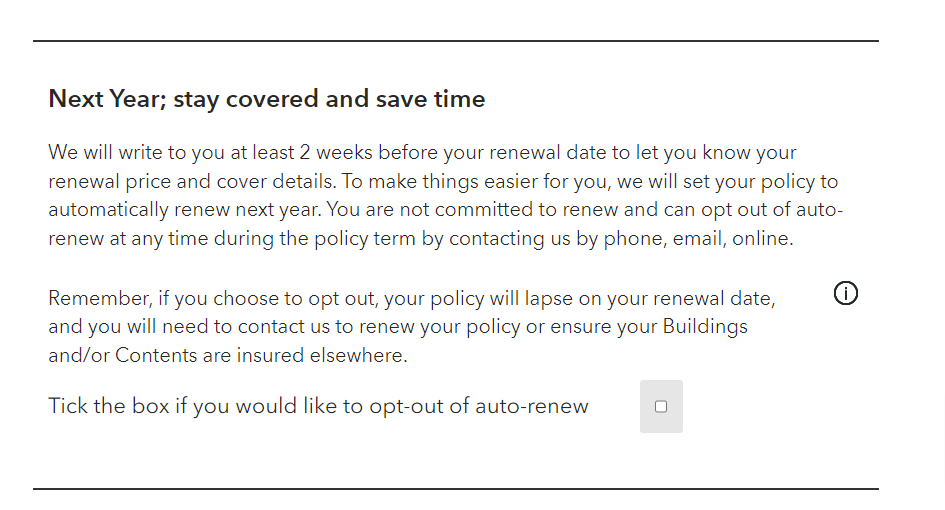

Privilege (15/02/2024)

This variation isn’t necessarily a problem; in fact, it’s good for brands to be creative in helping customers make informed choices. However, there should be a basic level of information provided to ensure customers understand their options before making a choice.

The key pieces of information that should be shared with customers to assist them in making their choices are as follows:

- Provide customers with a straightforward way to opt out of auto-renewal before purchasing the policy, without requiring additional clicks.

- Make customers aware of the potential risks associated with opting out.

- Inform customers that the price may increase upon auto-renewal.

- Ensure customers know they can cancel their auto-renewal at any time.

- Specify the time frame for when customers can expect a reminder letter before renewal.

- Offer comprehensive information on how customers can opt out after purchasing the policy.

It’s important not to overwhelm customers with unnecessary information, as it can increase cognitive load and cause them to overlook critical sections. By following these guidelines, brands can improve the user experience for auto-renewal processes, empowering customers to make informed choices, and build trust and loyalty.

In summary, the renewal process should prioritise consumers ease and accessibility, following UK best practices and regulatory standards outlined in the FCA Handbook. Brands should make auto-renewal the straightforward choice it should be.

* AA, Admiral, Age Co, Age Partnership, Ageas, Aviva, AXA, Bank of Scotland, Bradford & Bingley, Budget, Churchill, Co-operative Insurance, Dial Direct, Direct Line, esure, First Direct, Halifax,, Hastings Direct, HomeProtect, HSBC, John Lewis, Lloyds Bank, LV=, Marks & Spencer, MoreThan, Nationwide, Natwest, One Call Insurance, Policy Expert, Post Office, Privilege, Quotemehappy, RAC, RIAS, Royal Bank of Scotland, Saga, Sainsbury's, Santander, Swiftcover Swinton, Tesco Bank, Towergate, TSB, Urban Jungle, HomeInsurer.co.uk